This means that you must pass the lender’s income and affordability checks to qualify and your home may be repossessed if you don’t keep up your monthly interest repayments. It’s important to remember that RIO's are residential mortgages.

RETIREMENT INTEREST ONLY MORTGAGE CALCULATOR PLUS

RIO mortgages are typically offered by life insurance companies such as Legal & General, specialist RIO lenders like LiveMore and Hodge, plus building societies such as Nationwide. With a RIO mortgage, the balance is repaid when you die or move into long term care. With a conventional interest-only mortgage, the balance is repaid at the end of the term agreed with the lender. As a result, RIO’s and interest-only mortgages differ in the way the loan is repaid. The main difference is that RIO’s have no end date, or fixed term. RIO’s work in the same way as an interest only mortgage, whereby the accruing interest on the amount borrowed is repaid each month. RIO’s can offer an alternative to equity release, where disposable income is available to meet regular lifetime monthly payments. Retirement interest only mortgages have been specifically designed to help homeowners whose current interest only mortgages are coming to an end to carry them forward into retirement. An introduction to retirement interest only (RIO) mortgages This is the main criteria that lenders use when deciding how much money you can borrow. the age of the youngest homeowner (which must be typically at least 50).The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear, except where prohibited by law for our mortgage, home equity and other home lending products.How to use the retirement interest only mortgage calculatorįor an estimate of the maximum you could potentially borrow with a retirement interest only mortgage (RIO), simply input: To release equity from your home, you need to speak to a qualified adviser Taking out financial products such as Bookmarks is a big decision that could have meaningful repercussions, such as what kind of inheritance you leave behind Equity release payments could impact your tax obligations and your entitlement to certain benefits. student debt, the large sum of cash provided by the Equity, may go a long way especially in these situations.

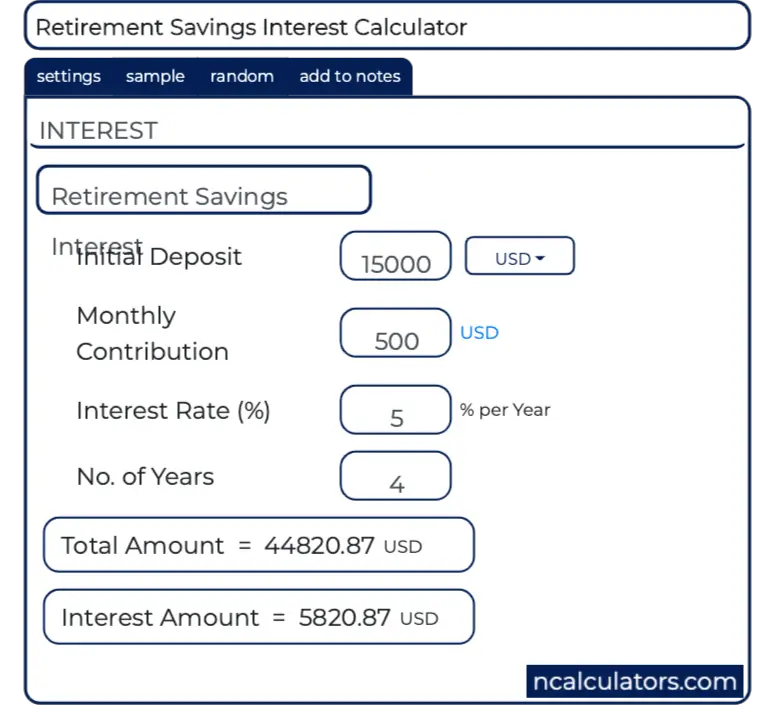

Since most equity releases are signed up by senior citizens, there’s always that chance that they may be doing it for that struggling child, who may be in deep financial stress, or they may just want to help with one of the major loans people are usually stuck with i.e. The difference is that with pay monthly (serviced) products, you pay the monthly interest amount charged each month, just as you would pay an interest only mortgage. The broker does not need to have an equity release qualification to help you find a retirement interest-only mortgage. Interest is charged on a monthly basis, whichever type of equity release product you look at. If you have a client over the age of 55 who would like to make the most of the equity in their property, but you are not qualified to provide advice in this area of the market, you can refer them on to our selected Equity Release partners who can give expert advice and get the right solution for your clients circumstance. This calculator will provide a quick estimate of how much money may be borrowed.

0 kommentar(er)

0 kommentar(er)